Canadian Real Estate Close to Sellers’ Market in July: CREA

July sales were up for the fifth consecutive month

Penelope Graham

other

A jump in annual sales and a decline in new supply put the squeeze on national real estate in July, pushing conditions to the brink of a sellers’ market.

Transactions rose for the fifth month in a row with a 12.6% year-over-year increase, and up 3.5% from June. The number of newly-listed homes brought to market stayed flat, however, down -0.4%. That’s put upward pressure on the national average home price, which rose 3.9% to $499,000; excluding the Greater Toronto and Greater Vancouver markets would reduce it to $393,000.

Canadian Housing Market Continues Recovery

Overall, the Canadian Real Estate Association says the market has recovered by 15% from its February low, though lingers 10% below peak activity in 2016 and 2017.

Sales were up in 60% of all local markets, with the majority of volume in the GVA and GTA and additional increases elsewhere in the BC Mainland, Calgary, Edmonton, Hamilton-Burlington, Ottawa, and Montreal.

While this uptick is partly the result of buyers acclimatizing to the national mortgage stress test and a lower interest rate environment, even the largest markets remain subdued compared to pre-policy levels, say CREA’s analysts.

“The extent to which recent declines in mortgage interest rates have helped lift sales activity varies by community and price segment,” states CREA President Jason Stephen.

Gregory Klump, the association’s chief economist, adds that while borrowers seem to be adjusting to the stress test, which adds roughly 2% to their borrowing qualification thresholds, its mark on sales remains apparent, especially in higher-priced housing markets and those facing economic challenges.

“Sales are starting to rebound in places where they dropped when the mortgage stress test took effect at the beginning of 2018, but activity there remains well below levels recorded prior to its introduction. By the same token, sales continue to rise in housing markets where the mortgage stress test had little impact due to upbeat local economic conditions and a supply of affordably priced homes,” he stated.

“Meanwhile, the mortgage stress test is doing no favours for home buyers and sellers alike in places facing challenging local economic prospects and subdued consumer sentiment.”

National Buying Conditions Approach Sellers’ Market

Markets got more competitive from a national perspective, as flat new listings and the increase in sales tightened up the country’s sales-to-new-listings ratio to 59.8%, from 57.6% in June. This ratio, which is calculated by dividing the number of sales by the number of new listings over the course of the month, gauges the level of buyer competition within a local market. A ratio between 40 – 60% signals a balanced market, with below and above that threshold indicating buyers’ and sellers’ conditions, respectively.

According to this criteria, the national housing market is poised on the edge of a sellers’ market with the “tightest reading and the biggest deviation above its long-term average (of 53.6%) in the past year.”

At a local level, however, three quarters of all markets can be considered balanced. However, the number of months of inventory – the amount of time it would take to sell all available housing stock on the market – fell to 4.7 months, the lowest level since December 2017 and below the long-term average of 5.3 months.

While this indicates oversupply from slower market conditions is starting to alleviate, CREA points out that inventory levels vary widely across the country, sitting much higher than average in the Prairies and Newfoundland and Labrador, and well below average in Ontario and the Maritimes.

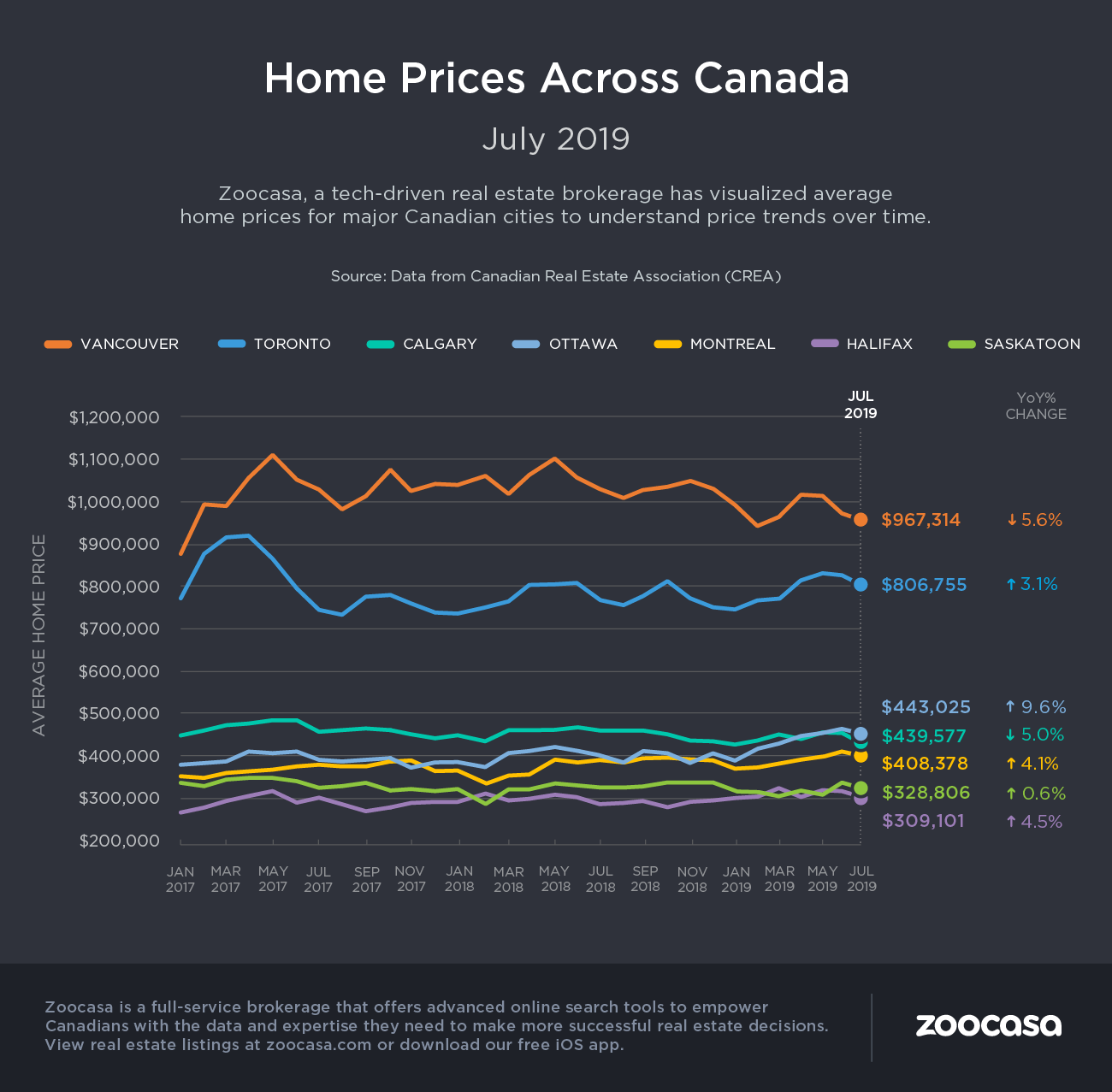

Price Growth Uneven East to West

The overall value of homes sold ticked up slightly, reflected in a 0.2% year-over-year increase in the MLS Home Price Index – the largest in two years. This is due to an uptick in two-storey single-family home prices, which rose 0.3%. One-storey single-family and condo prices stayed flat, while townhouse prices declined by -0.7%.

The widening gap between price trends continues across Canada, as western and prairie markets experience a downturn, while central and eastern provinces are seeing strong growth.

BC: Prices continue to fall for Greater Vancouver real estate by -9.4%, and by -6.7% in the Fraser Valley. The decline was much less pronounced in the Okanagan Valley at -0.9%, while prices rose 1.2% in Victoria, and up 3.4% elsewhere on Vancouver Island.

Ontario: Prices are up in most of the Greater Golden Horseshoe, rising 6.9% in Guelph, 5.9% in Niagara Region, 5% in Hamilton-Burlington, and 5% in Oakville-Milton. Sold prices in Toronto rose 4.4%. The Barrie and District market was the only one to see a decline, down -1.3%. The strongest price growth in the province continues to be in Ottawa, up 8.9%.

Prairies: The Prairie markets continue to suffer from oversupply while home sales falter, putting downward pressure on prices. They’re down -3.5% for Calgary real estate, -3.2% in Edmonton, -4.4% in Regina, and -1.3% in Saskatoon. “The home pricing environment will likely remain weak in these cities until demand and supply return to better balance,” states CREA’s report.

Eastern Canada: Price growth continues to be strong in Greater Montreal, up 7.3%, while values rose 2.4% in Greater Moncton.

© 2015-2017 Zoocasa Realty Inc.,